Nvidia Corporation, long heralded as the vanguard of the AI revolution, has recently found itself navigating through turbulent waters due to a confluence of regulatory, technological, and market dynamics. Introduction of DeepSeek R1 added high waves.

At the heart of Nvidia’s current spotlight is the U.S. government’s new export restrictions on AI chips. Designed to secure national interests, these regulations threaten Nvidia’s expansive growth in international markets, particularly in China, where the company has a significant stake. This move has sparked discussions on the balance between technological advancement and national security, with Nvidia’s business model directly in the crosshairs.

What Developments are Shaping the Narrative?

Following the excitement at CES 2025, where Nvidia unveiled its next-generation Blackwell chips aimed at enhancing AI, robotics, and autonomous vehicle technologies, the company faced unexpected hurdles. Reports of delays in the Blackwell chips’ rollout, attributed to overheating issues and software glitches, have raised concerns. Major clients like Microsoft and Meta have reportedly scaled back their orders, casting doubts over Nvidia’s ambitious $150 billion data center revenue goal for the year.

Moreover, Nvidia’s announcement of a long-term silicon photonics project with TSM suggests a strategic pivot towards future tech landscapes, though the benefits are years away from realization. This project underscores Nvidia’s commitment to pioneering technology, despite immediate operational challenges.

How is the Market Responding?

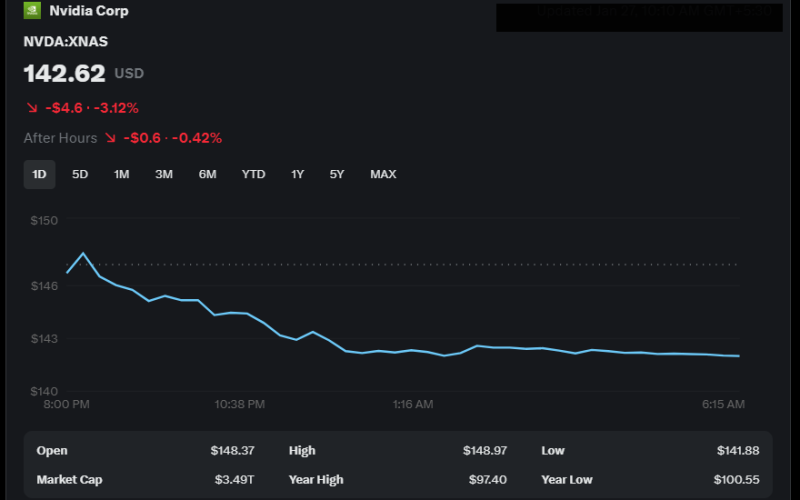

The market’s reaction has been a rollercoaster for Nvidia’s stock. After an initial surge post-CES announcements, shares experienced a downturn, reflecting investor caution over the company’s ability to navigate the new regulatory environment and technical setbacks. Analysts are divided; some see Nvidia’s long-term strategy aligned with the AI megatrend, predicting further growth, while others warn of potential overvaluation, drawing parallels to the dot-com bubble’s peak.

The broader implications for the U.S. tech sector are significant. Nvidia’s situation illustrates the delicate dance between innovation, market expectations, and geopolitical considerations. It raises questions about the sustainability of tech giants’ growth in an increasingly regulated global market and the potential for shifts in tech leadership if domestic policies continue to constrain international operations.

As Nvidia grapples with these multifaceted issues, the tech industry watches closely. The company’s response to these challenges will not only determine its own trajectory but might also set precedents for how tech companies manage the interplay of technology, regulation, and global commerce in the AI era.