Bitcoin Price Hits $99,000 Amid Global Optimism

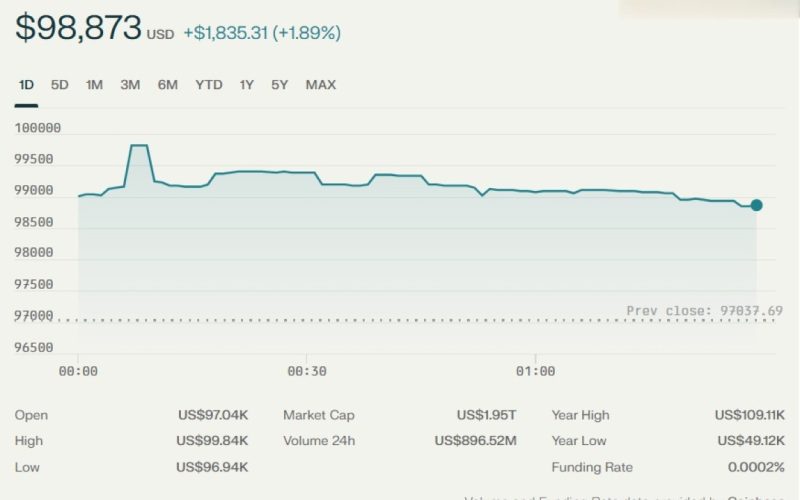

The world’s largest cryptocurrency, Bitcoin, surged past the $99,000 mark on May 8, 2025, marking a dramatic comeback after a volatile spring. As of 10:14 AM IST, Bitcoin traded at $99,300, reflecting a 2.59% daily gain and a remarkable 23% increase over the past month. This surge has put the crypto market in the global spotlight, with investors and analysts closely watching for Bitcoin’s next big move-potentially crossing the psychologically significant $100,000 threshold.

What’s Fueling the Bitcoin Rally?

Several factors have combined to ignite this rally. Positive developments in US-China trade relations and the announcement of a major trade deal by former US President Donald Trump have lifted market sentiment. These macroeconomic shifts have not only buoyed traditional markets but have also injected fresh optimism into the cryptocurrency sector. US equities closed higher, with the S&P 500, Nasdaq, and Dow all posting gains, reinforcing the risk-on mood that benefits digital assets like Bitcoin.

Institutional Inflows and ETF Momentum

A key driver behind Bitcoin’s latest rally is the surge in institutional interest. US spot Bitcoin ETFs recorded $105 million in net inflows in a single day, signaling robust demand from large investors. Tokyo-based Metaplanet’s recent acquisition of 555 BTC further underscores the growing trend of corporate treasury adoption. These moves reflect a broader belief in Bitcoin’s long-term value proposition and its role as a hedge against macroeconomic uncertainty.

Technical Analysis: Strong Support and Bullish Outlook

From a technical perspective, Bitcoin’s price action remains bullish. The cryptocurrency is trading above its 50-day, 100-day, and 200-day moving averages, indicating strong support levels. After rebounding from April’s lows near $74,000, Bitcoin has re-entered its consolidation zone, with resistance levels at $100,000 and $104,000. If momentum continues, analysts suggest a breakout above $100,000 could quickly propel prices toward new all-time highs, possibly in the $120,000–$130,000 range over the summer.

Market Sentiment and Volatility

Investor sentiment is overwhelmingly positive, but experts caution that volatility remains a defining feature of the crypto market. The sharp rebound from recent lows demonstrates Bitcoin’s resilience, but traders are advised to stay alert for potential pullbacks, especially as the price approaches key resistance zones. The current rally is supported by both retail and institutional investors, with capital rotating into high-potential altcoins as well.

Historical Context: From Halving to Highs

Bitcoin’s journey to $99,000 is part of a broader narrative shaped by its halving cycles and increasing mainstream adoption. The latest halving event in April 2024 reduced the supply of new BTC, creating a favorable supply-demand dynamic. Historically, such events have preceded bull runs, and 2025 appears to be following this pattern. In January, Bitcoin set a new all-time high of $109,000 before a sharp correction. The subsequent recovery highlights the asset’s enduring appeal and the maturing nature of the crypto market.

Expert Insights: What’s Next for Bitcoin?

Industry leaders like Avinash Shekhar, co-founder and CEO of Pi42, attribute the sharp rebound to market sensitivity around macroeconomic developments. He notes that as regulatory and economic factors evolve, heightened volatility is expected, but the underlying trend remains bullish. Analysts at CoinSwitch Markets Desk emphasize the significance of institutional momentum and technical strength, predicting that Bitcoin could close the month above $104,000 if current trends persist.

Beyond the Headlines: Unreported Trends

While the news focuses on price action and institutional flows, several underlying trends are shaping Bitcoin’s future. On-chain data reveals that long-term holders are accumulating BTC, reducing the available supply on exchanges and potentially setting the stage for further price appreciation. Additionally, the rise of decentralized finance (DeFi) and the integration of Bitcoin into broader financial systems are expanding its utility and appeal.

Personalities and Places: The Human Side of the Rally

The latest rally has brought renewed attention to key figures in the crypto space. Institutional investors, corporate treasuries, and retail traders are all playing a role in driving demand. Tokyo, as the base for Metaplanet’s latest acquisition, exemplifies the global nature of Bitcoin adoption. Meanwhile, social media influencers and analysts are fueling discussions and debates, reflecting the decentralized and participatory ethos of the crypto community.

Potential Risks and the Road Ahead

Despite the bullish outlook, risks remain. Regulatory uncertainty, macroeconomic shocks, and technological vulnerabilities could all impact Bitcoin’s trajectory. However, the combination of strong technicals, institutional adoption, and favorable macro trends suggests that Bitcoin is well-positioned to test-and potentially sustain-the six-figure milestone in the coming weeks.

Bitcoin at a Crossroads

As Bitcoin flirts with the $100,000 mark, the world watches to see if this historic milestone will be reached and maintained. The convergence of institutional interest, favorable economic conditions, and robust technical support paints a promising picture. Whether Bitcoin can sustain these gains depends on a complex interplay of global events, investor sentiment, and technological innovation. For now, the crypto market is riding a wave of optimism, with Bitcoin leading the charge into uncharted territory.